“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” – Seth Klarman.

Because it’s so easy to get pulled into watching TV and scrolling the news these past few months…

We highly recommend turning off the television, stop scrolling the news and STICK to your comprehensive financial plan / investment plan we have carefully created for you. It is designed to carry you through good markets and challenging ones.

There are a lot of things none of us can control going on in the world recently, so we recommend focusing on what we can control – our behaviour and how we choose to react to what’s going on.

Financial Markets and Portfolio Performance

It’s been a rough start to 2022 for investors. The S&P/TSX composite YTD is down 10.6% and the S&P 500 Index is down 16.9%. The Canadian bond benchmark (FTSE Canada Universe Bond Index) is down 9.8% YTD.

One thing’s for sure, markets will fluctuate. There are a variety of factors that impact the market (such as interest rates, the economy and politics) – so ups and downs happen everyday.

Remember that although markets inevitably dip, history shows that they recover over time. That’s why it’s important to stay focused on your long-term goals.

When we developed your portfolio, we spent time talking about your goals, reviewing how you feel about risk and looking at your timeline. That helped ensure we determined your portfolio in accordance with your unique situation.

Against this backdrop, client portfolios have held up relatively well. YTD – Balanced portfolios are down about 11.18% (compared to the Lipper Portfolio Benchmark down 13.22%) and Equity portfolios are down about 12.47% (Lipper Portfolio Benchmark down 15.18%).

While it’s difficult to get excited about negative returns, your portfolios are designed to be durable through active management through automatic rebalancing as needed and most of the funds are also run by institutional pool money managers.

The Importance of Active Rebalancing

It may be perceived that portfolio rebalancing may go on the back burner when financial markets are rising calmly as they did for most of 2021, but rebalancing works to keep the mix of assets in a portfolio in line with the investor’s risk-and-return profile no matter what happens in the markets.

Markets do not rise evenly – some sectors can go up while others go down, some stocks can go up faster than others (think Amazon and the other tech giants during the height of the pandemic) etc. Generally, when equity markets rise, fixed income markets fall and all of that movement can affect a portfolio’s asset allocation – and thus can affect future returns and risks.

Historically, rebalancing to fixed weights causes one to sell equities and buy bonds. For this reason, a portfolio that has not been rebalanced since 2002 would look very different today than it did back then.

For example, a hypothetical balanced portfolio of 60% equities and 40% fixed income purchased in January 2002 would now have a significant overweight in equities ad 72% and an underweight in fixed income at 29% (percentages rounded up).

More importantly, the weighting of U.S equity would have risen to 28% of the portfolio. Being so top-heavy in one region can be risky if U.S stocks were to suddenly plunge. Having to explain to a client why they now have a more aggressive allocation instead of the balanced one they thought they had is not a conversation we want to have.

Source: Russell Investments

The Not So Good News

In order to tame inflation, both the U.S and Canadian central banks are tightening their stance by raising interest rates due to the fact that it’s the only tool they have at their disposal.

The global pandemic and Russia’s invasion of Ukraine have been bad for globalization. Energy prices and supply chains have been the two most significant sources of inflation.

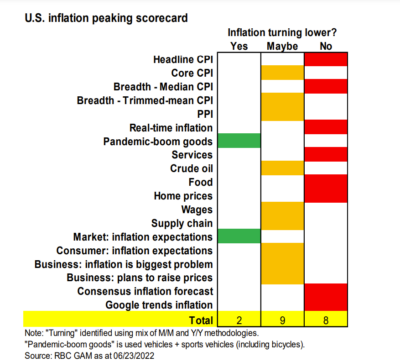

The second half of 2022 will have important implications for the economy and financial markets. Ideally, if inflation eases, then the central banks can tighten less aggressively – great for the markets. If inflation continues, then money ends up being removed from the financial system so there would be more market volatility.

The Good News

Employment has continued to remain strong and wages are rising – especially in low-wage sectors where the shortage of workers has been most prevalent.

The hard economic data remains decent, supply chain issues are easing and there’s a possibility that inflation may be peaking and commodity prices are dropping.

What next?

We’ve always said – it is impossible to time the market perfectly but purchasing businesses at attractive prices and holding them for the long-term has shown to be an extremely effective way to boost your portfolios.

We know you already know this but here’s an important reminder of the value of staying invested. In fact, we see it as a very opportunistic time to allocate funds into the market while everything is undervalued.

E&OE

Please do not hesitate to get in touch if you have any questions or if there’s anything we can do to help.

Thank you.

Warmest regards,

Kelly (she/her)

Kelly Ho, BA, CFP®, CCS™, ALMI

Partner